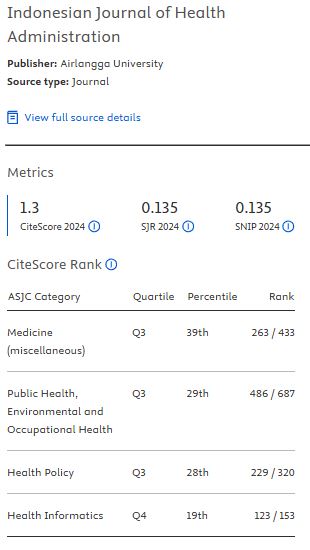

ANALYSIS OF THE MARKET STRUCTURE OF HOSPITAL INDUSTRY IN INDONESIA

Background: Over the past decade, private investments in health care including hospital have grown significantly, more than doubling. As the number of hospitals in Indonesia increases, a competitive business environment develops. Identifying hospital market structure can help various stakeholders to optimize the hospital's performance.

Aims: This study analyzed the market structure and concentration of the hospital industry in Indonesia.

Methods: This study used hospital characteristics data from Ministry of Health of Indonesia that retrieved in October 2020. Market concentration is determined by the number of industry players operating in a market, the distribution of services, and the types of services offered. The hospital market concentration was identified by measuring the Concentration Ratio (CR) and the Herfindahl–Hirschman index (HHI).

Results: The results showed that the market share of hospitals in Indonesia was still dominated by government hospitals, which represent 51.4% of the market share. The concentration ratio of four companies (CR4) remains <40, indicating that competition remains relatively open among private hospitals at the national level.

Conclusion: Several cities have established hospital markets that are characterized by robust competition, whereas in other cities, the hospital industry remains oligopolistic or monopolistic. It is important to note, however, that this does not imply that the market structure is ineffective on account of competition; rather, it is the result of a scarcity of hospitals in a number of Indonesian cities.

Keywords: Concentration ratio, Economic competition, Herfindahl–Hirschman Index, Hospital market

Introduction

Health spending measures the final consumption of health care goods and services(O.E.C.D., 2018). Global health spending reached US$ 8.3 trillion in 2018, about 10% of global gross domestic product(W.H.O., 2020). Before the Coronavirus Disease 2019 (COVID-19) pandemic in 2019, OECD countries spent ~8.8% of their Gross Domestic Product (GDP) on average on healthcare, a figure that has remained largely unchanged since 2013. The US spends the most on healthcare, equivalent to 16.8% of its GDP, well ahead of the next highest-spending country, Germany, at 11.7%(O.E.C.D., 2021).

At the global level, the hospital service market was worth US$ 9.58 trillion in 2020 and is expected to reach US$ 16.45 trillion by 2027(Research, 2022). Similar trends are seen in Central European countries, where healthcare is currently one of the largest sectors in Germany (11.0% of GDP), Austria (10.1%), Slovak Republic (7.6%), and the Czech Republic (7.1%)(Lauraéus & , 2021). Studies have shown that increased health spending positively correlates with economic growth(Raghupathi & Raghupathi, 2020).

Healthcare industry growth will continue while private interest in developing hospitals remains. Private investments in health services have increased dramatically over the last decade, more than doubling(Scheffler et al., 2023). The private sector in India invests in tier 2 and 3 cities and outside metropolitan cities, where hundreds of investment opportunities are available in the hospital sector(Sarwal & , 2021).

The health industry in Indonesia was estimated to reach US$ 60.6 billion in 2018, a growth of 14.9% compared to 2012– 2018. Significant growth was seen in the hospital sector, with 2,083 hospitals in 2012 increasing to 2,820 in 2018(Kuntjoro & Wibowo, 2018). The pharmaceutical industry sector grew by 11.4%, increasing from 193 industries in 2015 to 215 in 2017. The medical device industry also grew by 12.6%, increasing from 215 industries in 2015 to 242 in 2017(Indonesia, 2018).

Over the last 11 years, the number of hospitals in Indonesia has increased by 80%(Trisnantoro & Listyani, 2018). However, The Indonesian tourists’ demand for medical tourism services abroad is still high. It was estimated that the total money spent by Indonesian citizens for treatment in other Association of Southeast Asian Nations (ASEAN) countries in 2016 was US$ 11.5 billion annually, with the majority (80%) spent in Malaysia. Several private and public hospitals have expanded the number of beds or built new hospitals to overcome this. According to one study, the primary motivations of Indonesian tourists seeking medical treatment in Malaysia are dissatisfaction with Indonesian medical practices and a lack of expertise in the field(Md Zain & , 2022).

The hospital industry market in Indonesia is entering a more complex phase given that the Indonesian government has currently implemented the National Health Insurance (Jaminan Kesehatan Nasional [JKN]) program, operated by the Health Social Security Administration (Badan Penyelenggara Jaminan Sosial Kesehatan / BPJS Kesehatan). From an economic perspective, the JKN program has created greater demand in the health sector(Britton et al., 2018).

On the other side, the growth in the number of hospitals in Indonesia creates a competitive business climate. However, the existence of unfair business competition practices has an impact on various parties. Hidden yet perilous forms of competition exist in the Indonesian health service industry, according to the findings of a study; these include health business mafias, monopolies, and deceit involving the concealment of patient hands(Alfarizi & Zalika, 2023). Unfair business competition, for business actors and consumers, this practice can create an imbalance in business opportunities for various groups at different levels and can lead to consumer/ community losses. A broader interpretation of the loss would be inefficiency manifested in wastage or suboptimal resource allocation(CzyÅ1⁄4ewski & , 2020).

Identifying market structure of one industry is significant as efficiency is substantially impacted by the market structure within which a company, including a hospital, operates. The characteristics of the market structure dictate the level of competition, which varies from perfect competition, characterized by a multitude of small sellers and buyers, a homogeneous product, and price-taking by all, to pure monopoly, denoting a market with a single buyer, or monopoly, signifying a market with a single supplier. Other market structures exist between these two extremes, including monopolistic competition (many sellers and many buyers offering differentiated products) and oligopoly, which is characterized by a small number of sellers who vary in size and market power. Effective resource allocation results from the efficient operation of the market, which is facilitated by a number of conditions. The primary conditions are observable with respect to the structure of the market(Mwachofi & Al-Assaf, 2011).

Unfortunately, hospital market structure research in Indonesia remains understudied. One study has been conducted in 2014 examining hospital market structure in South Sumatera Province(Tatarifah, 2014). Another study has been conducted to identify the issue of competition in the Indonesian Health Services Industry(Alfarizi & Zalika, 2023). Therefore, this study analyses the Indonesian hospital industry’s market structure and competition map through the concentration ratio (CR) and Herfindahl– Hirschman Index (HHI).

Method

This study used hospital data originating from the Online Hospital Information System (SIRS), which was obtained in October 2020 (Ministry of Health of Indonesia, 2020). SIRS is a hospital reporting system in the Ministry of Health of Indonesia that comprises hospital identity data,

Alfarizi, M. and Zalika, Z. (2023) ‘Isu Persaingan Industri Pelayanan Kesehatan Indonesia: Tantangan dan "Perisai” Pengawasan KPPU', Jurnal Persaingan Usaha, 3(1), pp. 5–18. Available at: https://doi.org/10.55869/kppu.v3i1.89.

Bai, T. et al. (2020) ‘The falling growth in the use of private hospitals in Australia', SSRN Electronic Journal [Preprint]. Available at: https://doi.org/10.2139/ssrn.3725863.

Britton, K., Koseki, S. and Dutta, A. (2018) ‘Expanding Markets while Improving Health in Indonesia The Private Health Sector Market in the JKN Era'.

Calkins, S. (1983) ‘The New Merger Guidelines and the Herfindahl-Hirschman Index', California Law Review, 71(2), pp. 402–402. Available at: https://doi.org/10.2307/3480160.

Center for Health Statistics, N. (2017) Table 89. Hospitals, beds, and occupancy rates, by type of ownership and size of hospital: United States, selected years 1975–2015.

Cowley, P. and Chu, A. (2019) ‘Comparison of private sector hospital involvement for UHC in the western pacific region', Health Systems and Reform, 5(1), pp. 59–65. Available at: https://doi.org/10.1080/23288604.2018.1545511.

Czyżewski, B. et al. (2020) ‘Deadweight loss in environmental policy: The case of the European Union member states', Journal of Cleaner Production, 260. Available at: https://doi.org/10.1016/j.jclepro.2020.121064.

Frost and Sullivan (2019) Pasar Pelayanan Kesehatan Indonesia Diharapkan Mencapai Keuntungan, Frost & Sullivan. Available at: https://ww2.frost.com/news/press-releases.

Gwin, Carl.R. (2001) ‘A Guide for Industry Study and the Analysis of Firms and Competitive Strategy'. Available at: https://www.scribd.com/document/137034638/A-Guide-forIndustry-Study-and-the-Analysis-of-Firms-and-Competitive-Strategy-pdf.

Herawati, E. (2017) Rumah Sakit: Pilih Yayasan Atau Perseroan Terbatas?, Rubric of Faculty Members. Available at: https://business-law.binus.ac.id/2017/06/30/rumah-sakit-pilih-yayasan-atau-perseroan-terbatas/.

HPP and TNP2K (2018) The Financial Sustainability of Indonesia's National Health Insurance Scheme: 2017–2021, https://www.tnp2k.go.id/articles. Available at: https://www.tnp2k.go.id/download/516561.%20The%20Financial%20Suatainability%20of%20NHI.pdf.

Kuntjoro and Wibowo, D.B. (2018) ‘Tantangan Pertumbuhan Industri Pelayanan Kesehatan di Indonesia', in Seminar Nasional IV Peran industri Kesehatan dalam mendukung Pertumbuhan Ekonomi di Indonesia. Available at: https://indohcf.com/files/2018-04/03.-dr.-daniel-budi-wibowo-indohcf-2018.pptx.

Lauraéus, T. et al. (2021) ‘Market Structure analysis with Herfindahl-Hirchman Index and Lauraéus-Kaivo-Oja Indices in the Global Cobotics Markets', Economics and Culture, 18(1), pp. 70–81. Available at: https://doi.org/10.2478/jec-2021-0006.

Lubis, A.F. et al. (2017) Hukum Persaingan Usaha. Jakarta: Komisi Pengawas Persaingan Usaha (KPPU).

Md Zain, N.A. et al. (2022) ‘Intra-Regional Medical Tourism Demand in Malaysia: A Qualitative Study of Indonesian Medical Tourists' Rationale and Preferences', Malaysian Journal of Medical Sciences, 29(2), pp. 138–156. Available at: https://doi.org/10.21315/mjms2022.29.2.13.

Ministry of Health of Indonesia (2018) ‘Strategi mendongkrak industri farmasi dan alat kesehatan', in. Seminar Nasional IV Peran industri Kesehatan dalam mendukung Pertumbuhan Ekonomi di Indonesia. Available at: www.indochf.com.

Ministry of Health of Indonesia (2020) ‘Dashboard RS Online'. Available at: https://sirs.kemkes.go.id.

Mwachofi, A. and Al-Assaf, A.F. (2011) ‘Health Care Market Deviations from the Ideal Market', Sultan Qaboos University Medical Journal, 11(3), pp. 328–337.

Naldi, M. and Flamini, M. (2014) ‘The CR4 Index and the Interval Estimation of the Herfindahl-Hirschman Index: An Empirical Comparison', SSRN Electronic Journal [Preprint]. Available at: https://doi.org/10.2139/ssrn.2448656.

OECD (2018) ‘Health spending'. OECD. Available at: https://doi.org/10.1787/8643de7e-en.

OECD (2021) Health at a Glance 2021: OECD Indicators. OECD (Health at a Glance). Available at: https://doi.org/10.1787/ae3016b9-en.

Precedence Research (2022) Hospital Services Market Size, Share, Trends, Growth 2027. Available at: Available: https://www.precedenceresearch.com/hospital-services-marke.

Raghupathi, V. and Raghupathi, W. (2020) ‘Healthcare Expenditure and Economic Performance: Insights From the United States Data', Frontiers in Public Health, 8. Available at: https://doi.org/10.3389/fpubh.2020.00156.

Richman, B.D. (2012) ‘Concentration in Health Care Markets: Chronic Problems and Better Solutions'. Rochester, NY. Available at: https://papers.ssrn.com/abstract=2163749.

Sarwal, R. et al. (2021) Investment Opportunities in India's Healthcare Sector. NITI Aayog.

Scheffler, R.M., Alexander, L.M. and Godwin, J.R. (2023) ‘Soaring Private Equity Investment in the Healthcare Sector: Consolidation Accelerated, Competition Undermined, and Patients at Risk', SSRN Electronic Journal [Preprint]. Available at: https://doi.org/10.2139/ssrn.3860353.

Siloam International Hospitals (2022) Pencapaian Perusahaan - Siloam Hospitals. Available at: https://www.siloamhospitals.com.

Tatarifah, A.J. (2014) Struktur Pasar, Perilaku dan Kinerja Industri Jasa Pelayanan Keseahtan di Provinsi Sumatera Selatan. Undergraduate thesis. Universitas Sriwijaya.

Trisnantoro, L. and Listyani, E. (2018) ‘Jumlah RS di Indonesia Pertumbuhan RS Publik', April. Available at: https://www.persi.or.id/images/2017/litbang/rsindonesia418.pdf.

WHO (2020) Global spending on health 2020: weathering the storm. Available at: https://www.who.int/publications/i/item/9789240017788.

Ying, S. et al. (2022) ‘Industrial dynamics and economic growth in health-care context. Evidence from selected OECD countries', Journal of Business & Industrial Marketing, 37(8), pp. 1706–1716. Available at: https://doi.org/10.1108/JBIM-11-2020-0513.

Zhang, W. (2022) ‘Number of hospitals in Taiwan 2010-2020', Statista [Preprint]. Available at: https://www.statista.com/statistics/934717/taiwan-number-of-hospitals/.

Copyright (c) 2024 Yuyun Umniyatun, Emma Rachmawati, Deni Wahyudi Kurniawan, Mochamad Iqbal Nurmansyah, Mukhaer Pakkanna, Husnan Nurjuman, Slamet Budiarto, Virgo Sulianto Gohardi

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

1. As an author you (or your employer or institution) may do the following:

- make copies (print or electronic) of the article for your own personal use, including for your own classroom teaching use;

- make copies and distribute such copies (including through e-mail) of the article to research colleagues, for the personal use by such colleagues (but not commercially or systematically, e.g. via an e-mail list or list server);

- present the article at a meeting or conference and to distribute copies of the article to the delegates attending such meeting;

- for your employer, if the article is a ‘work for hire', made within the scope of your employment, your employer may use all or part of the information in the article for other intra-company use (e.g. training);

- retain patent and trademark rights and rights to any process, procedure, or article of manufacture described in the article;

- include the article in full or in part in a thesis or dissertation (provided that this is not to be published commercially);

- use the article or any part thereof in a printed compilation of your works, such as collected writings or lecture notes (subsequent to publication of the article in the journal); and prepare other derivative works, to extend the article into book-length form, or to otherwise re-use portions or excerpts in other works, with full acknowledgement of its original publication in the journal;

- may reproduce or authorize others to reproduce the article, material extracted from the article, or derivative works for the author's personal use or for company use, provided that the source and the copyright notice are indicated.

All copies, print or electronic, or other use of the paper or article must include the appropriate bibliographic citation for the article's publication in the journal.

2. Requests from third parties

Although authors are permitted to re-use all or portions of the article in other works, this does not include granting third-party requests for reprinting, republishing, or other types of re-use.

3. Author Online Use

- Personal Servers. Authors and/or their employers shall have the right to post the accepted version of articles pre-print version of the article, or revised personal version of the final text of the article (to reflect changes made in the peer review and editing process) on their own personal servers or the servers of their institutions or employers without permission from JAKI;

- Classroom or Internal Training Use. An author is expressly permitted to post any portion of the accepted version of his/her own articles on the author's personal web site or the servers of the author's institution or company in connection with the author's teaching, training, or work responsibilities, provided that the appropriate copyright, credit, and reuse notices appear prominently with the posted material. Examples of permitted uses are lecture materials, course packs, e-reserves, conference presentations, or in-house training courses;