Digitalisasi Usaha Mikro Kecil dan Menengah dalam Membangun Ketahanan Bisnis di Era New Normal

Downloads

Abstract

The research objectives are (a) Knowing the readiness of Micro, Small and Medium Enterprises (MSMEs) in digitalization to build business resilience in the new normal era; (b) Explaining digital business innovation for MSMEs in building business resilience in the new normal era. This research is basic research with the theme of digital marketing from MSMEs in building business resilience in the new normal era. The MSME business can absorb a large workforce which has implications for reducing unemployment and improving the economy so that it has an impact on reducing the poverty rate as the goal of the Sustainable Development Goals. Conclusion Readiness to digitize MSMEs to Build Business Resilience in the New Normal Era: MSMEs are not fully ready to immediately switch to digital. Smartphones or laptops connected to the internet are quite a lot owned by MSMEs in running a business, but not all of them use them to market their products digitally. MSME Innovations in Building Business Resilience in the New Normal Era include: Adapting to new ways of working, integrated digital and technology systems, resilient supply chains, building business relationships; improve service quality; study business technology; social media understanding; selling on marketplaces.

Abstrak

Tujuan penelitian adalah (a) Mengetahui kesiapan Usaha Mikro Kecil dan Menengah (UMKM) dalam digitalisasi untuk membangun ketahanan bisnis di era new normal; (b) Menjelaskan digital business innovation UMKM dalam membangun ketahanan bisnis di era new normal.Penelitian ini merupakan penelitian dasar dengan tema Digitalisasi pemasaran dari UMKM dalam Membangun Ketahanan Bisnis di Era New Normal. Bisnis UMKM dapat menyerap tenaga kerja yang besar implikasinya dapat menurunkan pengangguran dan peningkatan ekonomi sehingga berdampak pada penurunan angka kemiskinan sebagaimana tujuan Sustainable Development Goals. Kesimpulan Kesiapan digititalisasi UMKM Untuk Membangun Ketahanan Bisnis di Era New Normal: UMKM ini tidak sepenuhnya siap untuk serta merta beralih ke digital. Smartphone atau Laptop terkoneksi internet cukup banyak dimiliki pelaku UMKM dalam menjalankan usaha, namun tak semua menggunakannya untuk memasarkan produk secara digital. Innovation UMKM Dalam Membangun Ketahanan Bisnis di Era New Normal diantaranya adalah: Beradaptasi dengan cara kerja yang baru, sistem digital dan teknologi terintegrasi, rantai pasokan yang tangguh, bangun relasi bisnis; tingkatkan kualitas layanan; belajar teknologi bisnis; pemahaman media sosial; jualan di marketplace.

Dwi Andayani.2020. Pilkada Tak Kompetitif, Pemilih Apatis, selengkapnya https://news.detik.com/berita/d-5121919/perludem-ungkap-dampak-calon-tunggal-pilkada-tak-kompetitif-pemilih-apatis.

Arasti, Z. (2011). An empirical study on the causes of business failure in Iranian context. African Journal of Business Management, 5(17), 7488–7498. https://doi.org/10.5897/AJBM11. 402.

Cavallari, M., De Marco, M., Rossignoli, C., Casalino, N. (2015), Risk, Human Behavior, and Theories in Organizational Studies, Proceedings of Wuhan International Conference on E-Business, WHICEB 2015, Wuhan, China, AIS, Association for Information Systems, AIS Electronic Library (AISeL), pp.283-297

Chin, L. P., & Ahmad, A. Z. (2015). Perceived enjoyment and Malaysian consumers' intention to use a single platform e-payment. SHS Web of ConFerence, 18(1), 1–9. https://doi.org/10. 1051/shsconf/201.51.01009.8

Dinas Koperasi dan Usaha Kecil Provinsi Jawa Timur, 2021. Infografis Kontribusi UMKM pada Perekonomian di Jawa Timur. Dalam https://data.diskopukm.jatimprov.go.id/satu_data/

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340. https://misq.org/misq/downloads/ download/article/494/

Dacin, M. T., Goodstein, J., & Scott, W. R. (2002). Institutional theory and institutional change: Introduction to the special research forum. Academy of Management Journal, 45(1), 45–57. https://doi.org/10.5465/amj.2002.6283388

Hamari, J., Sjoklint, M., & Ukkonen, A. (2016). The sharing economy: Why people participate in collaborative consumption. Journal of the Association for Information Science and Technology, 67(9), 2047–2059. https://doi.org/10.1002/asi.23552

Henderson, R., & Divett, M. J. (2003). Perceived usefulness, ease of use and electronic supermarket use. International Journal of Human-computer Studies, 59(3), 383–395. https://doi. org/10.1016/S1071-5819(03)00079-X

Iramani, N. A., Fauzi, A. A., Wulandari, D. A., & Lutfi, N. A.. (2018). Financial literacy and business performance improvement of micro, small, medium-sized enterprises in East Java Province, Indonesia. International Journal of Education

Ibrahim, M. A., & Shariff, M. N. M. (2016). Mediating role of access to finance on the relationship between strategic orientation attributes and SMEs performance in Nigeria. International Journal of Business and Society, 17(3), 473–496. http://www.ijbs.unimas.my/ images/repository/pdf/Vol17-no3-paper6.pdf

Jan, P.-T., Lu, H.-P., & Chou, T.-C. (2012). The adoption of e-learning: An institutional theory perspective. The Turkish Online Journal of Educational Technology, 11(3), 326–343. Retrieved October 4, 2017, from http://www.tojet.net/articles/v11i3/11331.pdf

Kabir, M. A., Saidin, S. Z., & Ahmi, A. (2015). Adoption of e-payment systems: A review of literature. In Proceedings of the International Conference on E-Commerce (ICoEC) 2015 (pp. 112–120). Kuching, Serawak, Malaysia. Retrieved October 4, 2017, from https://aidi-ahmi. com/download/publication/2015_ICoEC_kabir_saidin_ahmi.pdf

Koufaris, M. (2002). Applying the technology acceptance model and flow theory to online consumer behavior. Information Systems Research, 13(2), 205–223. https://doi.org/10.1287/ isre.13.2.205.83

Kementerian Koperasi dan Usaha Kecil dan Menengah, 2020.

Lawrence, T. B., & Shadnam, M. (2008). Institutional theory. In The International Encyclopedia of Communication

Lu, J., Yu, C.-S., Liu, C., & Yao, J. E. (2003). Technology acceptance model for wireless Internet. Internet Research, 13(3), 206–222. https://doi.org/10.1108/10662240310478222

Mohlmann, M. (2015). Collaborative consumption: Determinants of satisfaction and the likelihood of using a sharing economy option again. Journal of Consumer Behaviour, 14(3), 193–207. https://doi.org/10.1002/cb.1512

Miles, Matthew B. and A. Michael Huberman. 2005. Qualitative Data Analysis (terjemahan). Jakarta : UI Press.

Miliani, L., Purwanegara, M. S., & Indriani, M. T. D. (2013). Adoption behavior of e-money usage. Information Management and Business Review, 5(7), 369–378. https://doi.org/10. 22610/imbr.v5i7.1064

Nguyen, T. N., Cao, T. K., Dang, P. L., & Nguyen, H. A. (2016). Predicting consumer intention to use mobile payment services: Empirical evidence from Vietnam. International Journal of Marketing Studies, 8(1), 117. https://doi.org/10.5539/ijms.v8n1p117

Pimoljinda, T., & Siriprasertchok, R. (2018). SMEs development and ASEAN economic integration: An analysis of Singapore and Malaysia. Pertanika Journal of Social Science and Humanities, 26(1), 507–518. Retrieved from http://www.pertanika.upm.edu.my/Pertanika% 20PAPERS/JSSH%20Vol.%2026%20(1)%20Mar.%202018/30%20JSSH-2077-2017-3rdProof. Pdf

Puschmann, T., & Alt, R. (2016). ‘Sharing economy', Business and Information Systems Engineering. Springer Fachmedien Wiesbaden, 58(1), 93–99. https://doi.org/10.1007/s12599- 015-0420-2

Sakudo, M.2020. The New Normal: Digitalization of MSMEs in Indonesia. https://www.asiapacific.ca/publication/new-normal-digitalization-msmes-indonesia. akses 10 April 2021

Setyowati, D. (2018) Terus ekspansi, mitra Go-Food kini 300 ribu, Katadata News. katadata.co. id. Retrieved April 14, 2019, from https://katadata.co.id/berita/2018/11/05/terus-ekspansimitra-go-food-kini-300-ribu

Simon, H.A. (1985), A formal Theory of the employment relation, trad. it. Causalití , razionalití , organizzazione, Il Mulino.

Teo, H., Wei, K., & Benbasat, I. (2003). Predicting intention to adopt interorganizational linkages: An institutional perspective. MIS Quartely, 27(1), 19–49. https://doi.org/10.2307/ 30036518

Teima, G., Berthaud, A., Bruhn, M., De Castro, O., Joshi, M., Mirmulstein, M., & Onate, A. (2010) Scaling-up SME access to financial services in the developing world. International Finance Corporation, World Bank Group. International Finance Corporation. Retrieved from http://docu ments.worldbank.org/curated/en/669161468140035907/pdf/ 948300WP0Box385443B00PUBLIC00ScalingUp.pdf

Yang, S., Lu, Y., Gupta, S., Cao, Y., & Zhang, R. (2012). Mobile payment services adoption across time: An empirical study of the effects of behavioral beliefs, social influences, and personal traits. Computers in Human Behavior, 28(1), 129–142. Elsevier Ltd https://doi.org/ 10.1016/j.chb.2011.08.019.

Copyright (c) 2022 Authors

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

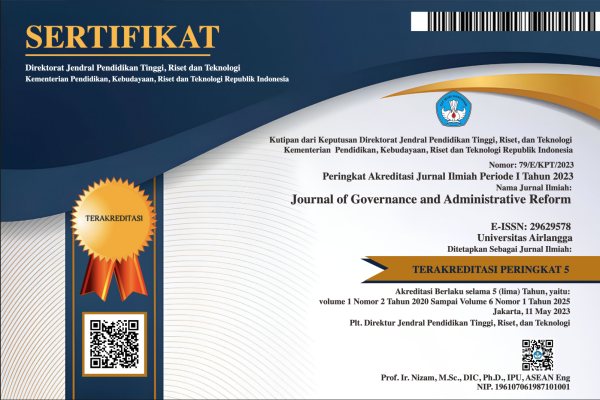

Jurnal Governance and Administrative Reform by Unair is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

1. The journal allows the author to hold the copyright of the article without restrictions.

2. The journal allows the author(s) to retain publishing rights without restrictions

3. The legal formal aspect of journal publication accessibility refers to Creative Commons Attribution Share-Alike (CC BY-SA).