Digital Innovation And Business Strategy for SMEs: Building Resilience In The Society 5.0 Era

Downloads

Abstrak

Usaha Mikro Kecil dan Menengah (UMKM) telah lama menjadi pilar utama dalam struktur ekonomi Indonesia, menggerakkan roda perekonomian dengan kontribusi yang signifikan. Namun, dalam kondisi perekonomian yang dinamis, eksistensi dan pertumbuhan UMKM masih terus diuji. Tantangan terbesar yang dihadapi pelaku UMKM adalah perubahan paradigma bisnis yang ditandai oleh era Society 5.0. Teknologi telah menjadi kekuatan utama yang mengubah lanskap bisnis secara fundamental. Perubahan ini menciptakan peluang besar, tetapi juga menimbulkan ketidakpastian. Digitalisasi menjadi kunci untuk mengoptimalkan peluang tersebut, terutama dalam pemasaran produk UMKM. Tujuan penelitian ini adalah menganalisis strategi pengembangan UMKM untuk membangun ketahanan bisnis era new Era society 5.0. Kendati teknologi telah menciptakan peluang yang lebih besar bagi UMKM, namun kesiapan mereka dalam beradaptasi dengan digitalisasi belum sepenuhnya terwujud. Kesimpulannya, UMKM menghadapi perubahan paradigma yang signifikan dalam menghadapi era Society 5.0. Digitalisasi menjadi kunci untuk meningkatkan ketahanan bisnis UMKM dengan menerapkan technopreneurship, meskipun kesiapan mereka dalam mengadopsi perubahan tersebut masih menjadi perhatian. Inovasi dalam hal produk, keterlibatan dalam pameran dan festival, penggunaan media sosial dan influencer untuk mempromosikan produk, pembangunan relasi bisnis, peningkatan kualitas layanan, pemahaman media sosial, penjualan melalui marketplace adalah beberapa langkah strategis yang perlu ditempuh untuk memastikan kelangsungan bisnis UMKM di society 5.0

Abstract

Micro, Small and Medium Enterprises (MSMEs) have long been the main pillars in Indonesia's economic structure, driving the wheels of the economy with a significant contribution. However, in dynamic economic conditions, the existence and growth of MSMEs is still being tested. The biggest challenge faced by MSME players is the change in business paradigm marked by the Society 5.0 era. Technology has become a major force that has fundamentally changed the business landscape. These changes create great opportunities, but they also introduce uncertainty. Digitalization is the key to optimizing these opportunities, especially in marketing MSME products. The aim of this research is to analyze MSME development strategies to build business resilience in the new Era society 5.0 era. Even though technology has created greater opportunities for MSMEs, their readiness to adapt to digitalization has not yet been fully realized. In conclusion, MSMEs are facing a significant paradigm shift in facing the Society 5.0 era. Digitalization is the key to increasing the resilience of MSME businesses by implementing technopreneurship, although their readiness to adopt these changes is still a concern. Innovation in terms of products, involvement in exhibitions and festivals, use of social media and influencers to promote products, building business relationships, improving service quality, understanding social media, selling through marketplaces are some of the strategic steps that need to be taken to ensure the continuity of MSME businesses in society 5.0

Sakudo, M. The New Normal: Digitalization of MSMEs in Indonesia. https://www.asiapacific.ca/publication/new-normal-digitalization-msmes-indonesia. (2020)

Davis, F. D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340. https://misq.org/misq/downloads/ download/article/494/. (1989).

Koufaris, M. Applying the technology acceptance model and flow theory to online consumer behavior. Information Systems Research, 13(2), 205–223. https://doi.org/10.1287/ isre.13.2.205.83. (2002).

Lu, J., Yu, C.-S., Liu, C., & Yao, J. E. Technology acceptance model for wireless Internet. Internet Research, 13(3), 206–222. https://doi.org/10.1108/10662240310478222. (2003).

Henderson, R., & Divett, M. J. Perceived usefulness, ease of use and electronic supermarket use. International Journal of Human-computer Studies, 59(3), 383–395. https://doi. org/10.1016/S1071-5819(03)00079-X. (2003).

Chin, L. P., & Ahmad, A. Z. Perceived enjoyment and Malaysian consumers' intention to use a single platform e-payment. SHS Web of ConFerence, 18(1), 1–9. https://doi.org/10. 1051/shsconf/201.51.01009.8. (2015).

Miliani, L., Purwanegara, M. S., & Indriani, M. T. D. Adoption behavior of e-money usage. Information Management and Business Review, 5(7), 369–378. https://doi.org/10. 22610/imbr.v5i7.1064. (2013).

Pimoljinda, T., & Siriprasertchok, R. SMEs development and ASEAN economic integration: An analysis of Singapore and Malaysia. Pertanika Journal of Social Science and Humanities, 26(1), 507–518. Retrieved from http://www.pertanika.upm.edu.my/Pertanika% 20PAPERS/JSSH%20Vol.%2026%20(1)%20Mar.%202018/30%20JSSH-2077-2017-3rdProof. Pdf. (2018).

Iramani, N. A., Fauzi, A. A., Wulandari, D. A., & Lutfi, N. A.. Financial literacy and business performance improvement of micro, small, medium-sized enterprises in East Java Province, Indonesia. International Journal of Education. (2018).

Teima, G., Berthaud, A., Bruhn, M., De Castro, O., Joshi, M., Mirmulstein, M., & Onate, A. Scaling-up SME access to financial services in the developing world. International Finance Corporation, World Bank Group. International Finance Corporation. Retrieved from http://docu ments.worldbank.org/curated/en/669161468140035907/pdf/ 948300WP0Box385443B00PUBLIC00ScalingUp.pdf. (2010)

Arasti, Z. An empirical study on the causes of business failure in Iranian context. African Journal of Business Management, 5(17), 7488–7498. https://doi.org/10.5897/AJBM11. 402. (2011).

Ibrahim, M. A., & Shariff, M. N. M. Mediating role of access to finance on the relationship between strategic orientation attributes and SMEs performance in Nigeria. International Journal of Business and Society, 17(3), 473–496. http://www.ijbs.unimas.my/ images/repository/pdf/Vol17-no3-paper6.pdf. (2016).

Puschmann, T., & Alt, R. ‘Sharing economy', Business and Information Systems Engineering. Springer Fachmedien Wiesbaden, 58(1), 93–99. https://doi.org/10.1007/s12599- 015-0420-2. (2016).

Lawrence, T. B., & Shadnam, M. Institutional theory. In The International Encyclopedia of Communication. (2008).

Dacin, M. T., Goodstein, J., & Scott, W. R. Institutional theory and institutional change: Introduction to the special research forum. Academy of Management Journal, 45(1), 45–57. https://doi.org/10.5465/amj.2002.6283388. (2002).

Kabir, M. A., Saidin, S. Z., & Ahmi, A. Adoption of e-payment systems: A review of literature. In Proceedings of the International Conference on E-Commerce (ICoEC) 2015 (pp. 112–120). Kuching, Serawak, Malaysia. Retrieved October 4, 2017, from https://aidi-ahmi. com/download/publication/2015_ICoEC_kabir_saidin_ahmi.pdf. (2015).

Teo, H., Wei, K., & Benbasat, I. Predicting intention to adopt interorganizational linkages: An institutional perspective. MIS Quartely, 27(1), 19–49. https://doi.org/10.2307/ 30036518. (2003).

Nguyen, T. N., Cao, T. K., Dang, P. L., & Nguyen, H. A. Predicting consumer intention to use mobile payment services: Empirical evidence from Vietnam. International Journal of Marketing Studies, 8(1), 117. https://doi.org/10.5539/ijms.v8n1p117. (2016).

Yang, S., Lu, Y., Gupta, S., Cao, Y., & Zhang, R. Mobile payment services adoption across time: An empirical study of the effects of behavioral beliefs, social influences, and personal traits. Computers in Human Behavior, 28(1), 129–142. Elsevier Ltd https://doi.org/ 10.1016/j.chb.2011.08.019. (2012).

Jan, P.-T., Lu, H.-P., & Chou, T.-C. The adoption of e-learning: An institutional theory perspective. The Turkish Online Journal of Educational Technology, 11(3), 326–343. Retrieved October 4, 2017, from http://www.tojet.net/articles/v11i3/11331.pdf. (2012).

Mohlmann, M. Collaborative consumption: Determinants of satisfaction and the likelihood of using a sharing economy option again. Journal of Consumer Behaviour, 14(3), 193–207. https://doi.org/10.1002/cb.1512. (2015).

Hamari, J., Sjoklint, M., & Ukkonen, A.. The sharing economy: Why people participate in collaborative consumption. Journal of the Association for Information Science and Technology, 67(9), 2047–2059. https://doi.org/10.1002/asi.23552. (2016).

Sulistyono, M., Hidayat, Y., & Syafari, M. R. (2022). Strategy for empowerment of micro, small and medium enterprises (MSMEs) food sector by the office of cooperatives, small/micro businesses and industry of balangan regency. Journal of Development Studies, 1(1), 39-48.

Mukhlis, A., Moeins, A., & Sunaryo, W. (2022). DEVELOPMENT STRATEGIES FOR MICRO, SMALL, AND MEDIUM ENTERPRISES (MSME) BY IMPROVING THE QUALITY OF HUMAN RESOURCES. International Journal of Economy, Education and Entrepreneurship, 2(2), 525-536.

Utami, I. D., Novianti, T., & Setiawan, F. (2023). Digital Strategy for Improving Resilience of Micro, Small, and Medium Enterprises. Jurnal Sistem dan Manajemen Industri, 7(1), 43-52.

Copyright (c) 2023 Authors

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

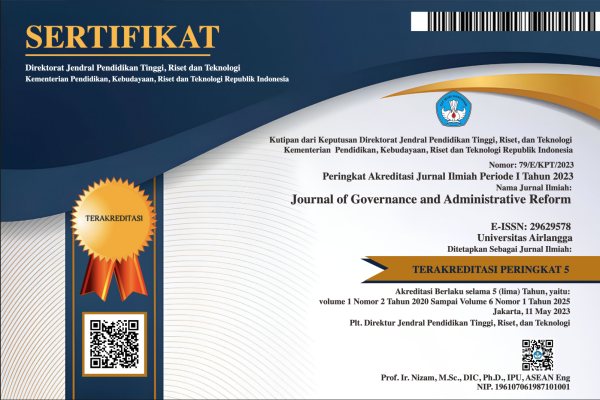

Jurnal Governance and Administrative Reform by Unair is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

1. The journal allows the author to hold the copyright of the article without restrictions.

2. The journal allows the author(s) to retain publishing rights without restrictions

3. The legal formal aspect of journal publication accessibility refers to Creative Commons Attribution Share-Alike (CC BY-SA).